Back to Industries

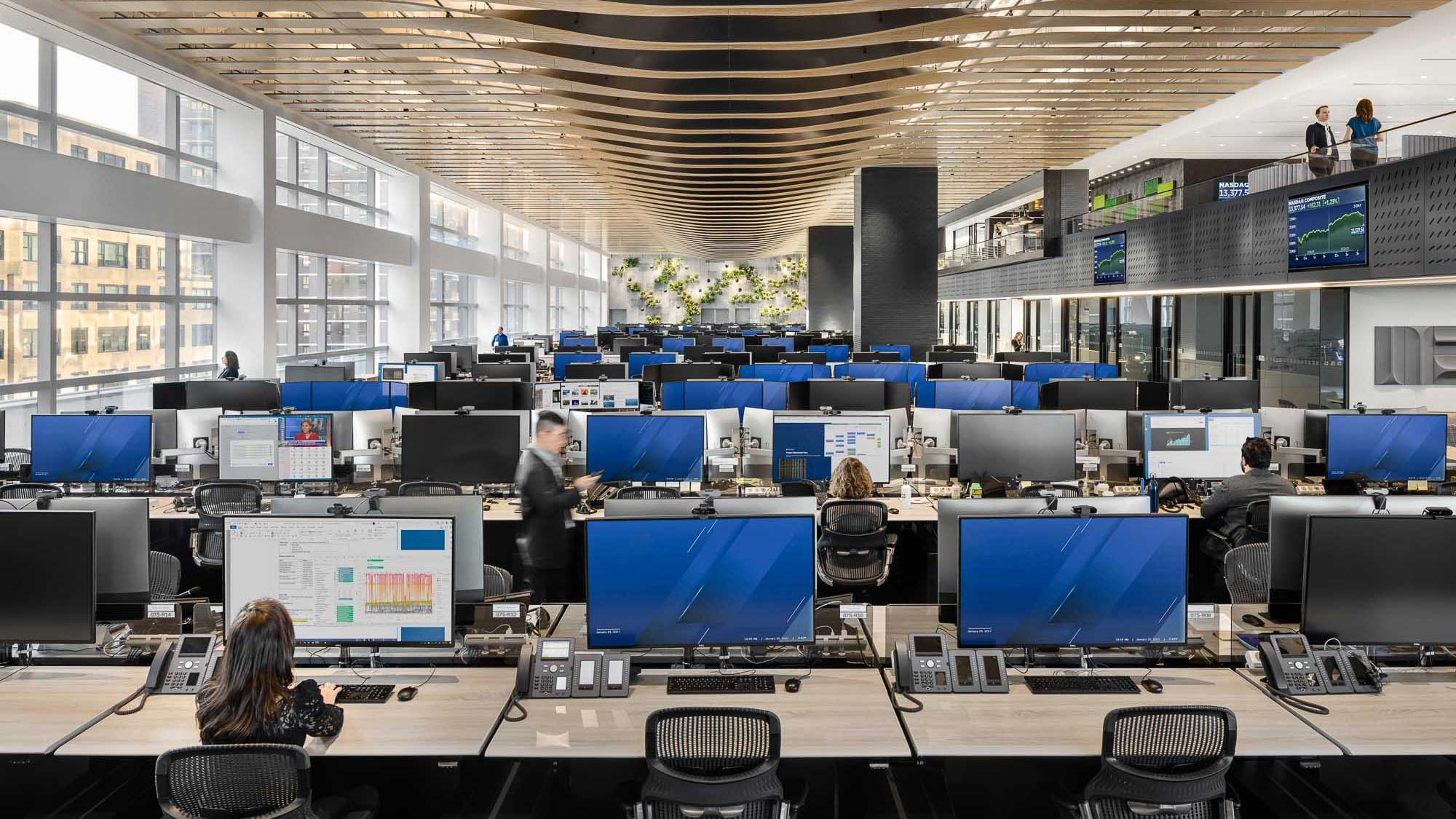

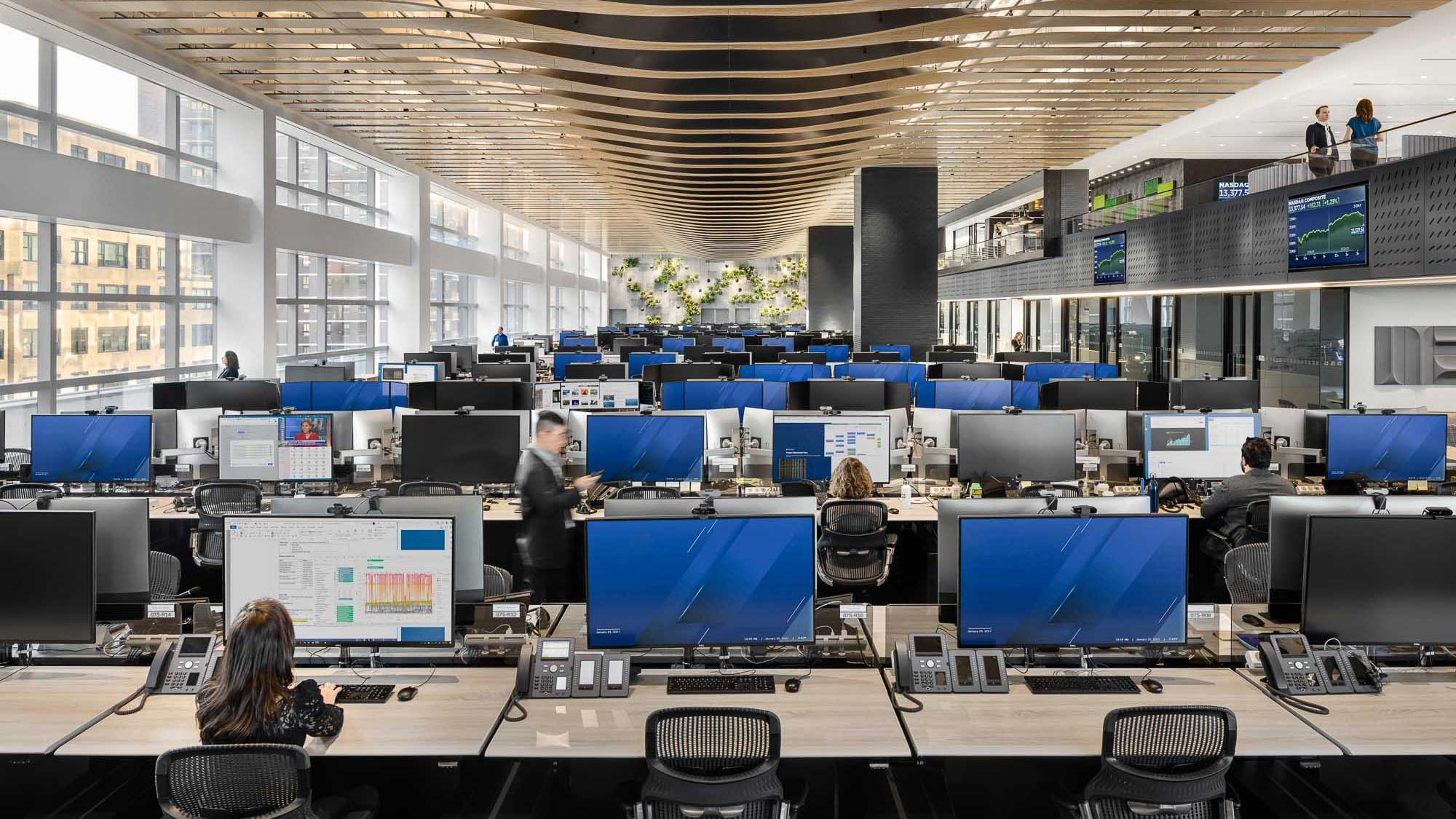

Financial Industries & High-Frequency Trading Security Solutions

The Reality Gap: The Login Fallacy

Finance assumes that a correct password equals a trusted user. But once a session is active on a trading terminal or an advisor's laptop, security often stops.

A logged-in screen left unattended for even seconds can expose trades, client portfolios, or wire instructions to the wrong person.

Why SpiAlert Changes the Equation

- •Continuous human presence: The authorized trader or advisor is verified throughout the session.

- •No behavioral analytics: We do not infer identity from typing patterns. We verify real presence.

- •Instant visual protection: Screens blur the moment the authorized user steps away.

- •High-value workflows covered: Trades, wires, and approvals stay tied to the verified user in real time.

- •Audit-ready logs: Presence events add strong evidence for audits and disputes.

Where SpiAlert Helps

These are the financial assets and workflows where continuous presence delivers the most value.

Trading Terminals & OMS

- •Confirms the authorized trader is present during execution.

- •Auto-blurs screens when the trader steps away.

- •Logs presence for trade disputes and audits.

Wire Transfers & Treasury

- •Adds a human-presence gate to high-value approvals.

- •Helps prevent unauthorized viewing of sensitive account data.

- •Creates presence records for compliance teams.

Remote Advisory Desks

- •Keeps client portfolios visible only to the advisor.

- •Detects shoulder surfers in public environments.

- •Obfuscates screens instantly on walk-away.

Risk & Market Data Ops

- •Keeps sensitive models and pricing dashboards visible only to verified users.

- •Prevents unauthorized viewing during shift changes.

- •Logs verified presence for audits.

Vendors & Outsourcing

- •Verifies contractor identity during privileged sessions.

- •Blocks access if the verified face is not present.

- •Provides proof-of-presence for third-party audits.

Travel & Executive Reviews

- •Keeps board decks and M&A screens private during reviews.

- •Auto-blurs when an exec looks away or a bystander appears.

- •Runs on-device with no cloud storage.

Forensic Integrity

Presence-verified logs show who was on-screen and when, adding clarity to investigations.

Active Prevention Beats Remediation

SpiAlert reduces visual data exposure before it becomes a loss event or regulatory issue.

Data Sovereignty by Design

Verification stays on-device. No biometric templates or video are stored, and no PII is collected.